Many business owners in Pennsylvania must add a task to their to-do lists: Filing an annual report with the Pennsylvania Department of State.

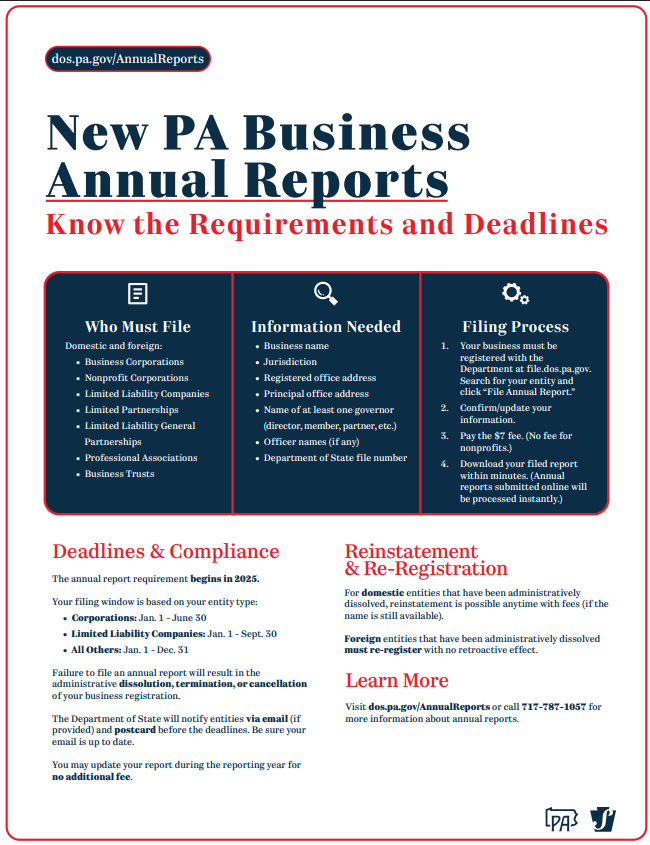

Starting this year, domestic and foreign entities registered to do business in the Commonwealth – including limited-liability companies or LLCs, corporations, partnerships and nonprofit organizations – are required to fill out and file a two-page annual report form.

People doing business using fictitious names, general partnerships that are not limited-liability partnerships, financial institutions and credit unions are not required to submit annual reports, according to the Department of State.

The annual reports for LLCs are due by Tuesday, September 30. The filing deadline for corporations and nonprofits was June 30. Other entities, including partnerships, must submit their reports by December 31.

The filing fee is $7.00 for for-profit entities. There is no charge for nonprofits.

Filers are required to supply the following information in the annual report:

Filers are required to supply the following information in the annual report:

- the name of the business as identified in Department of State records;

- the jurisdiction (state or country) where the business was formed;

- the registered office address in Pennsylvania as identified in Department of State records;

- the principal office address;

- the name of at least one “governor” who manages the activities of the company (i.e., director, member or partner);

- the names and titles of any principal officers; and

- the entity number issued by the Department of State.

A company other than a corporation might not have any principal officers. Officers include a president, secretary, treasurer and any other such officers as may be authorized by a corporation.

No financial information is required to be submitted.

The information contained in the annual reports will be displayed on the Department of State’s public website at file.dos.pa.gov/search/business, as well as whether businesses are compliant with the annual reporting requirements.

Information in an annual report must be current as of the date the report is delivered to the Department of State for filing.

Online filing is recommended. The lawyers at Labovitz Law Group can assist with the preparation and filing of the annual reports, or business owners can do it themselves. The Department of State website provides details concerning this new requirement, including a step-by-step guide for e-filing annual reports: https://www.pa.gov/agencies/dos/programs/business/types-of-filings-and-registrations/annual-reports

The requirements pertaining to the filing of annual reports are found in 15 Pa.C.S. Section 146.

The state is delaying until 2027 the imposition of penalties for failing to file annual reports.

According to the Department of State, “The new Annual Report requirement is a significant change for Pennsylvania. Therefore, Act 122 requires that the Department provide associations with a transition period before imposing any dissolution/termination/cancellation for failure to file Annual Reports. Beginning with Annual Reports due in 2027, associations that fail to file annual reports in the 2027 calendar year will be subject to administrative dissolution/termination/cancellation six months after the due date of the Annual Report.”

Prior to 2025, Pennsylvania required most business entities to file a decennial report once every ten years to maintain their registration.

If you have any questions about the Pennsylvania annual report filing requirement or other legal matters, you may contact attorney William Labovitz at (412) 533-3279, or wlabovitz@labolawgroup.com. For more information, visit the firm’s website at labolawgroup.com.